As a child, I remember having life-size, inflatable punching

bags. They looked like cartoon characters, and sand filled the bottom so they

would bounce right back after being knocked down. Since 2017, the Texas

Legislature has used retired public-school employees as their bounce-back

punching bags.

I retired from

teaching in 2013. For the first four

years, I had good, affordable insurance. But in 2017, without warning, the Texas

Legislature raised the deductible for all Teacher Retirement System (TRS)

retirees under the age of 65 from $400 to $1500. (Remember that TRS is a

misnomer as it actually covers ALL public-ed retirees, including bus drivers,

custodians, maintenance staff, police officers, teachers, administrators,

librarians, classroom aides, counselors, cafeteria staff….)

Prior to 2017, we also had a co-pay

for doctors’ visits and prescriptions. Not only did they nearly quadruple our

deductible, but they also robbed us of a co-pay. Now we have to pay the entire $1500 out of

pocket before our insurance pays a penny--except for preventive procedures,

such as mammograms--and a list of standard generic drugs. (If a retiree has his/her

spouse on the plan, that couple must meet the $3000 deductible—rather than

$1500 per person—before insurance kicks in.)

You may

remember that Texas has two pension systems—TRS and ERS. ERS is the Employees

Retirement System, which handles pensions and health care for all other state employees.

While our deductible went from $400 to $1500 in 2017, the health-care deductible

for ERS retirees went from $0 to $0. ZERO. Oh, and their monthly premium went

from $0 to $0. ZERO. Ours is $200 per month. Did I mention that

retired Texas legislators are covered under ERS health care and receive a

pension from ERS?

COLA

Since I

retired in 2013, I have not received a single cost-of-living adjustment (aka

COLA). According to Consumer

Price Index inflation calculator, “ The dollar had an average inflation

rate of 2.02% per year between 2013 and today, producing a cumulative price

increase of 19.68%.” My monthly pension

has had a 0 percent increase since 2013.

ZERO.

You may be shocked to learn that the last time the Texas Legislature provided TRS retirees with a COLA was in 2013, BUT…and it’s a BIG but…it was a 3 percent increase, capped at $100 per month, and it was only for public-school employees who retired prior to September 1, 2004. Yes, 2004. So for the past 18 YEARS, public-school employees have received ZERO COLAs. ZERO.

13th Check

Despite another

Legislative Session spent pushing for a COLA, in 2021, once again, our cries

fell on deaf ears. In the end, during a Special Session, our legislators chose

to ignore the fact that we have gone all these years without a COLA and instead

approved a “13th check,” capped at $2400.

It works like this: If a TRS retiree earns less than $2400 per

month in his/her annuity payment, the 13th check would be equal to his/her

monthly payment. Those earning over $2400 per month would ger $2400. These

checks were sent to us mid-January.

While I

think most of us would rather get something, than nothing, it was another punch

to TRS bounce-back retirees. My check arrived, minus $346.37. I immediately

thought of my retired colleagues who earn far less:

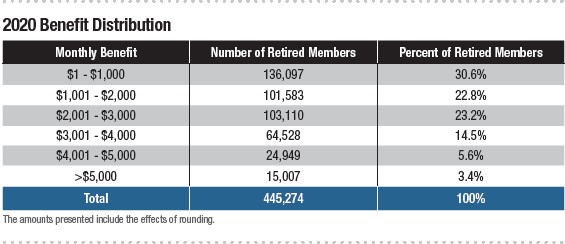

Please look at this carefully. The highest percentage—30.6%--of TRS retirees earn a monthly benefit (annuity payment) of $1 - $1000, and those who retired since September 1, 2004, have NEVER had a COLA!

Latest Blow

Just as TRS

retirees across the state were reeling from the large deductions taken from our

13th check, we received another blow from TRS via the U.S.P.S. Every

January, TRS sends us a letter to show us the difference in our net monthly

annuity from the previous year to the current year. Normally—and I am NOT kidding—it will show an

increase of $1.00 or so. When I received

mine, it showed I would be receiving $140.71 LESS in 2022 than I did in

2021. How do Texas legislators

expect us to continue while earning LESS?

Have you seen

the gas prices recently? Grocery prices? ALL prices? I immediately contacted TRS via DM on Twitter

and received a quick response: “…generally, a one-time supplemental payment is

treated as taxable income to an eligible annuitant. Your withholding rate will

return to normal on your February payment. In February, TRS will send out a new

letter with a comparative summary of the January and February annuity payments.

This will show the changes in the IRS withholding for your February and future

annuity payments in 2022. If you see a higher withholding amount for your

January annuity payment, it is likely because receiving the supplemental

payment in addition to your annuity payment increased your rate of withholding

for the month of January. Lastly please note, the IRS released new annual tax

withholding tables at the end of December that were applied to the January

payments, so you may also notice those nominal adjustments to your withholding

amount.”

1. 1. WHY

wasn’t this possibility discussed when the Texas Legislature was once again

denying us a COLA and attempting a final-hour, heroic act with a 13th

check?

2. 2, WHY would TRS send these letters out in January, upsetting everyone at a time when there is enough stress related to inflation, our UNaffordable health care, and COVID instead of providing us with January AND February–December payment information?

And….

WHY do public-ed retirees continue to be their bounce-back punching bags?

Chris Ardis retired in May of 2013 following a 29-year

teaching career. She now works as a freelance writer and editor and is

committed to education, educators, and students. Chris can be reached at

cardis1022@aol.com. (Photo by Linda Blackwell, McAllen.)

Why?????? Because what are u gonna do about it. And even if u do something. Who cares???!!!! The legislature won't. You wanted to teach. That's what you wanted to do.

ReplyDeleteYou're right. It is what I chose to do. And when I---and millions of others--chose to work in public education, we did so on a promise of having affordable health care in our retirement. Perhaps we were not promised an annual COLA, but because for many of us, this IS our "social security," what we ask is that we have an annual COLA comparable to the one SS recipients receive.

DeleteI detect anger in your questions. Is there a reason for this?

This comment has been removed by a blog administrator.

ReplyDeleteThey keep treating teachers this way because too many teachers keep voting for them. We need to “clean house” in Austin.

ReplyDeleteI totally agree, but, IN ADDITION, many, MANY more of the 1.5+ TRS members need to GET INVOLVED!

DeleteMy check will by much less, but it all is going into withholding taxes. I'm wondering how I'm going to cut back.

ReplyDeleteI know exactly what you mean. I think we all are. I hope you are involved in our work to try to turn this around!!!

DeleteWhen I first entered the teaching profession, after having spent time in another career, I was told by many teachers they didn't worry about the legislature because it would always take care of teachers. Ha. Most legislators of the past (and many now) have thought teachers are second wage earners for their families, so their money is just for fun or extra things not for a main source of income. Well they are wrong. What if one is single or both partners are teachers. The insurance is always more than one expects, and the retire benefits percentage used to determine the income for teachers is less than ERS. Yes, it is past time to clean house in Austin. Find a candidate who truly supports education, especially a Governor who will appoint an education friendly Commissioner.

ReplyDeleteExactly! That truly WAS the "promise" of becoming a teacher. Most of us always knew we could earn more in the private sector but chose the field of education. I know I always believed the "promise" and felt it was kept--until 2017. It has just been one blow after another since then.

DeleteI hope you are involved in our work to turn things around?!

At the end of 2020, the TRS retirement fund had $176.8 billion in the bank. The Texas Legislature uses this fund for WHATEVER THEY DESIRE, since they oversee this fund. The TRS investment isn't much better - they were the primary owners of the new Indeed Tower in downtown Austin, and planned on occupying several floors at a great expense to our retirement fund. This is humiliating and devastating and awful. Add the WEP and the GPO to this, and it is just a cluster.

ReplyDeleteAMEN!

DeleteBut, since you are obviously on top of things, why did they back out of the Indeed Tower? Because of THE OUTRAGE!

So my question is, WHERE IS THAT OUTRAGE from our colleagues NOW? THAT is what we need!!!!

I am still not understanding what the heck is going on with it all. I also am so mad I could spit, it seems just when we think maybe we can get a little help we get knocked down. In our case it is 2 steps forward 5 steps back. I got my letter that I can get SS but they will take 2/3 of it. So all the years I worked before and during and after retirement is going to someone else. What really makes me mad is that it most likely going to the same ones that are keeping us from getting that small $$$ amount.

ReplyDeleteI know, and I am equally angry. It is a constant fight, with both our state (TRS--pension and health care) AND federal (WEP and GPO) government. But so few are in the game with us to RESTORE what has been taken from us.

Delete